Looking to make headway in cutting your emissions and minimizing your carbon footprint? Look no further than the recently published "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost". This remarkable resource is your one-stop shop for everything you need to know about CO2 taxes, from understanding the basics to calculating your emissions footprint and developing strategies to minimize your costs.

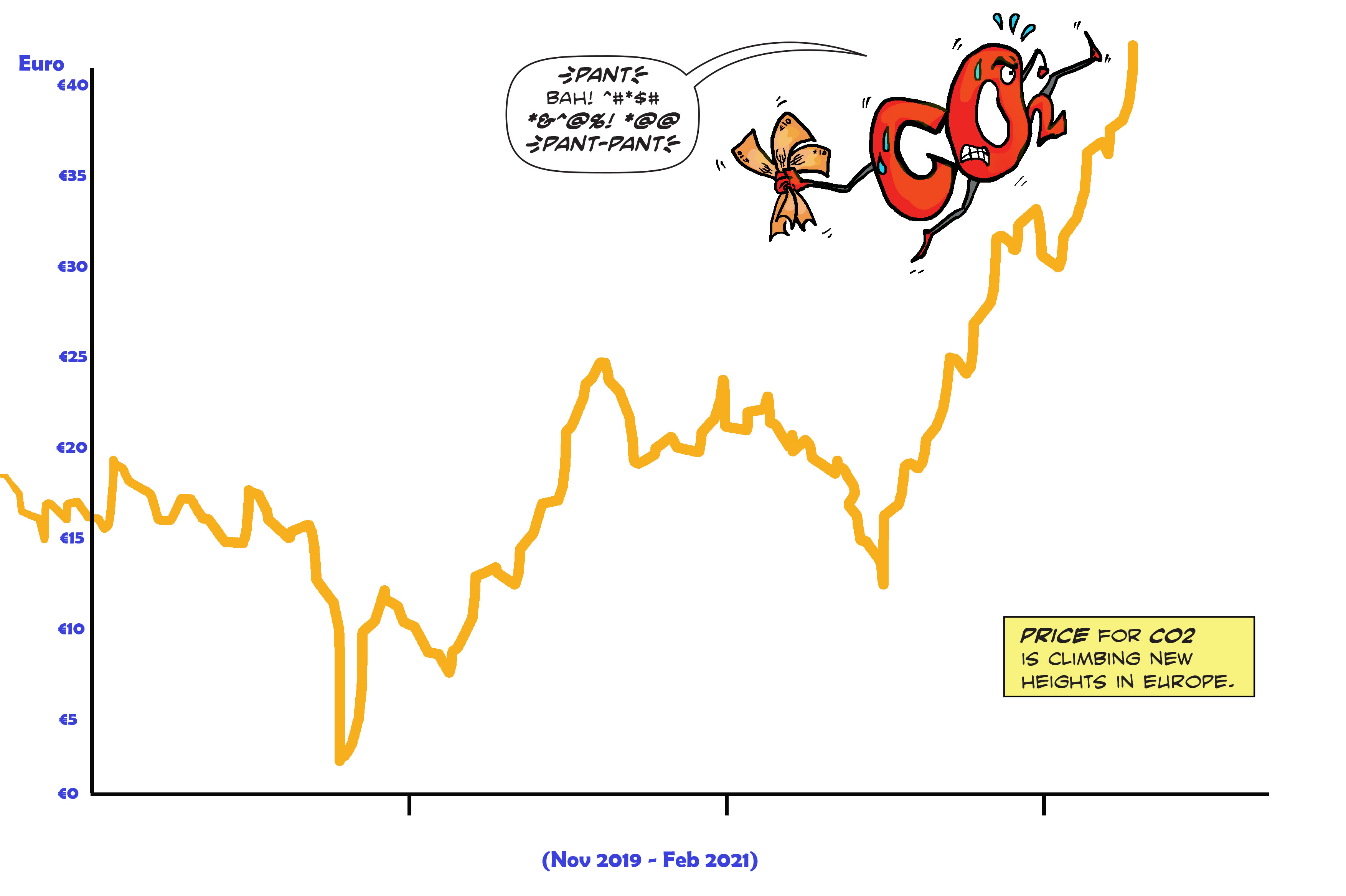

Understanding the European Union’s Emissions Trading Systems (EU ETS - Source www.cleanenergywire.org

Editor's Note: "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost" has just been published today, offering critical insights into this pressing topic. The guide is a must-read resource for businesses and individuals seeking expert guidance on mitigating their emissions and meeting sustainability goals.

Through meticulous research and analysis, this guide provides valuable support for anyone seeking to embrace sustainability and reduce their carbon footprint.

Key Differences

| CO2 Tax | Carbon Tax | |

|---|---|---|

| Tax Base | Carbon dioxide emissions | Carbon content of fuels |

| Tax Rate | Varies by jurisdiction | Typically fixed |

| Coverage | Can cover all sectors | Typically covers energy-intensive industries |

FAQ

This comprehensive guide provides valuable insights to comprehend, evaluate, and minimize CO2 emissions-related expenses. Explore common questions and answers to enhance your understanding.

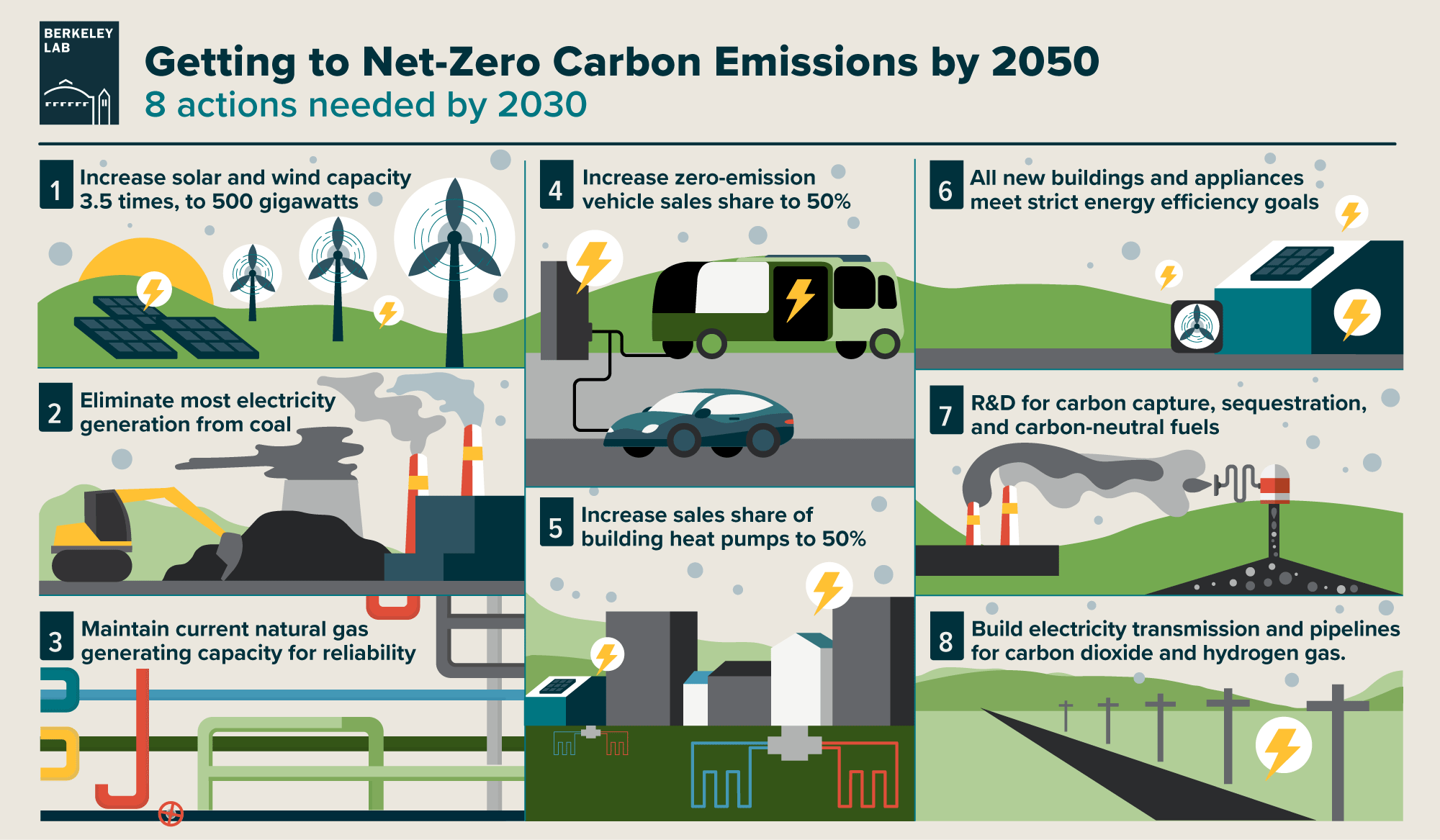

Getting to Net Zero Carbon Emissions – and Even Net Negative – Is - Source scitechdaily.com

Question 1: What is a carbon tax?

A carbon tax imposes a fee on the emission of greenhouse gases, particularly carbon dioxide (CO2). It aims to discourage excessive emissions, incentivize cleaner energy sources, and generate revenue to support climate mitigation efforts.

Question 2: How is a carbon tax calculated?

Carbon taxes are typically calculated based on the amount of CO2 emissions produced. The tax rate may vary depending on factors like industry, fuel type, and jurisdiction.

Question 3: What are the benefits of implementing a carbon tax?

Carbon taxes can help reduce greenhouse gas emissions, promote energy efficiency, stimulate innovation in clean technologies, and generate revenue for climate-related programs.

Question 4: What are the potential drawbacks of a carbon tax?

Concerns include potential impacts on energy affordability, economic growth, and the burden on certain industries. Effective implementation requires careful design and mitigation strategies to address these concerns.

Question 5: How can businesses prepare for a carbon tax?

Businesses should assess their emissions footprint, explore emission reduction strategies, evaluate financial implications, and consider investments in energy efficiency and low-carbon technologies.

Question 6: What is the future outlook for carbon taxes?

As global recognition of the climate crisis intensifies, the implementation of carbon taxes is expected to become more widespread. Governments and businesses alike must work together to develop effective and equitable approaches.

Understanding carbon taxes is crucial for navigating the transition to a low-carbon economy. Informed decisions and collective action will enable us to mitigate climate change and secure a sustainable future.

Next: Understanding Carbon Offsets

Tips

Implementing a carbon tax can incentivize businesses and individuals to reduce their greenhouse gas emissions.

Tip 1: Implement a carbon tax that is meaningful and gradually increased over time.

Tip 2: Provide flexibility in how businesses can comply with the carbon tax.

Tip 3: Use the revenue from the carbon tax to fund clean energy investments and other programs that reduce emissions.

Tip 4: Monitor and evaluate the effectiveness of the carbon tax on a regular basis.

Tip 5: Engage with stakeholders to build support for the carbon tax.

By implementing these tips, governments can create a carbon tax that is effective in reducing emissions, encourages innovation, and promotes economic growth.

For more information on carbon taxes, refer to CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost.

CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost

Understanding, calculating, and reducing CO2 emissions costs requires comprehensive knowledge of the subject matter. Various aspects are vital to grasp the broader concept, and this guide explores six key aspects for a thorough understanding:

- Definition and Purpose: A CO2 tax is a levy on the carbon content of fuels, encouraging reduced emissions.

- Economic Impact: The tax can have significant implications for businesses and industries, driving innovation and potentially raising consumer prices.

- Carbon Pricing Mechanisms: Different approaches exist, such as cap-and-trade systems and carbon taxes, each with distinct implications for emission reduction strategies.

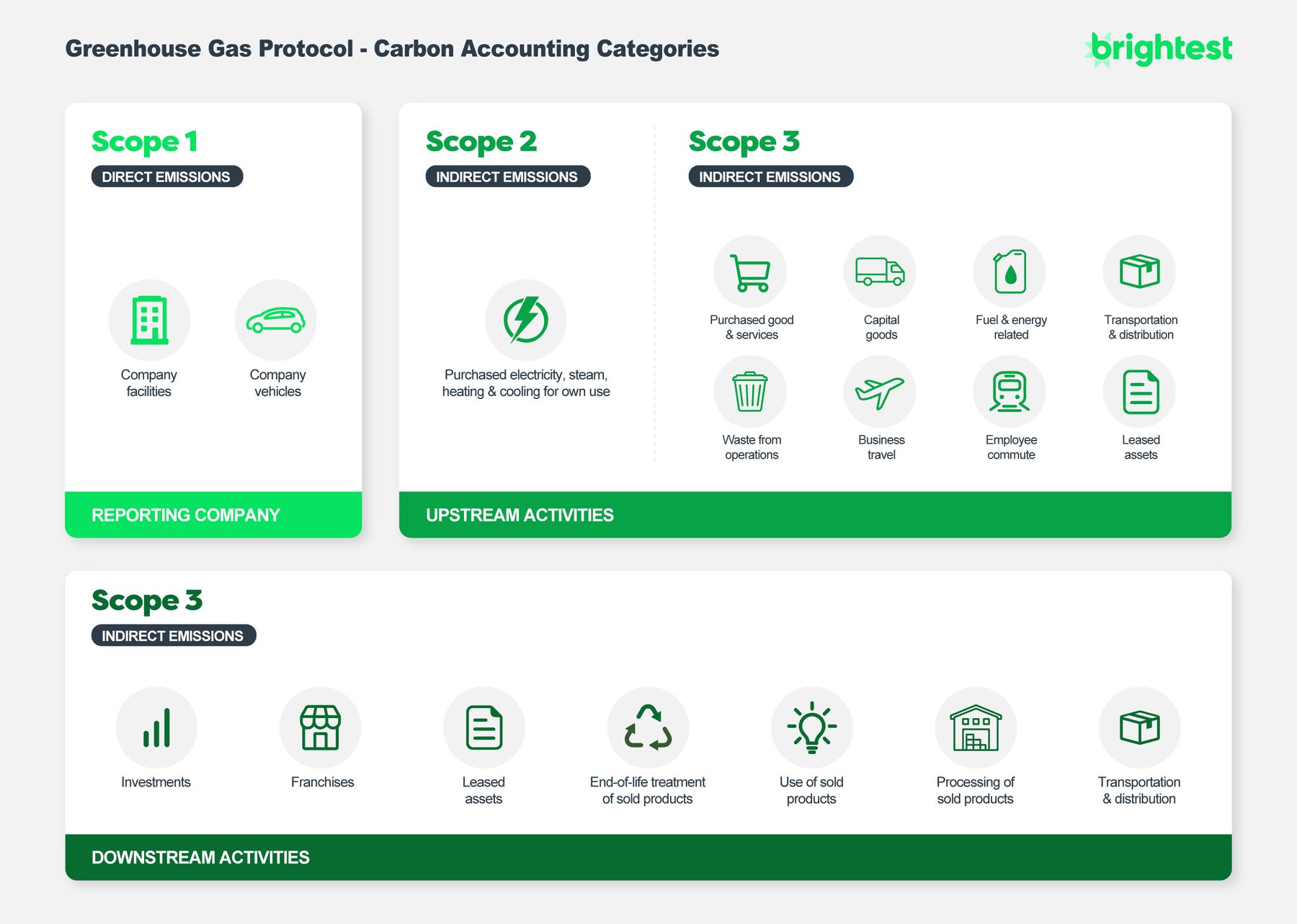

- Calculating Emissions: Accurately measuring and quantifying CO2 emissions is crucial for effective management and reduction.

- Emission Reduction Strategies: Implementing energy-efficient technologies, adopting sustainable practices, and investing in renewable energy sources are key strategies for reducing emissions.

- Policy and Regulation: Government policies and regulations play a significant role in shaping CO2 taxation and emission reduction efforts.

These aspects are interconnected, influencing the implementation and effectiveness of CO2 taxes. For example, understanding the economic impact helps businesses plan for potential costs and adjust their operations. Accurate emission calculations enable targeted reduction strategies, while government policies provide the framework for taxation and emission control. Tackling CO2 emissions requires a comprehensive approach that considers these aspects to achieve meaningful outcomes.

CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost

The "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost" serves as a crucial component in tackling climate change and transitioning towards a more sustainable future. It provides a clear understanding of carbon pricing mechanisms, enabling businesses and individuals to calculate and manage their carbon footprint effectively. By incorporating real-life examples and practical applications, the guide empowers stakeholders to make informed decisions and adopt strategies that reduce their emissions and align with environmental regulations. The insights gained from this guide are essential for navigating the complexities of carbon emissions management, promoting responsible practices, and contributing to the collective effort of achieving net-zero emissions.

The guide's comprehensive approach addresses the challenges faced in measuring and reducing carbon emissions, offering practical solutions that can be implemented across various sectors. It emphasizes the importance of understanding the carbon footprint, setting reduction goals, and exploring innovative technologies that minimize environmental impact. The guide also highlights the role of collaboration and knowledge-sharing, encouraging stakeholders to engage with experts and share best practices to drive collective progress towards a low-carbon economy.

In addition to theoretical principles, the guide provides practical tools and resources for calculating carbon emissions accurately. It introduces reputable methodologies and platforms that assist businesses and individuals in estimating their greenhouse gas emissions, enabling them to establish a baseline and track progress over time. By utilizing these tools, stakeholders can make data-driven decisions and identify areas where emissions can be reduced effectively.

The guide extends its insights to cover the impact of CO2 taxes on the economy, examining potential effects on competitiveness, innovation, and job creation. It explores the role of government incentives and policy frameworks in encouraging businesses to invest in emissions reduction technologies and adopt sustainable practices. The analysis provides a balanced perspective, considering both the economic and environmental implications of carbon pricing.

Overall, the "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost" offers a comprehensive and practical approach to understanding, calculating, and reducing carbon emissions. It empowers stakeholders to make informed decisions, adopt sustainable practices, and contribute to the global effort to mitigate climate change.

| Key Insights |

|---|

| Understanding carbon pricing mechanisms |

| Calculating and managing carbon footprints |

| Adopting strategies for emissions reduction |

| Utilizing carbon calculation tools and resources |

| Navigating the economic implications of CO2 taxes |

How to Collect Scope 3 Emissions Data - Source www.brightest.io

Conclusion

The "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost" serves as an essential guide for businesses, organizations, and individuals committed to reducing their environmental impact and contributing to a sustainable future. It provides a clear understanding of carbon pricing mechanisms and offers practical tools and strategies for calculating, managing, and reducing greenhouse gas emissions effectively.

By promoting informed decision-making and empowering stakeholders to take ownership of their carbon footprint, the guide plays a vital role in transitioning towards a low-carbon economy. It fosters collaboration and knowledge-sharing, encouraging organizations to adopt innovative technologies that minimize environmental impact. The guide also highlights the importance of policy frameworks and government incentives in driving collective progress towards net-zero emissions.

In summary, the "CO2 Tax: A Comprehensive Guide To Understanding, Calculating, And Reducing Your Emissions Cost" is a comprehensive resource that empowers stakeholders to address the challenges of climate change and build a more sustainable future for generations to come.