Understanding US Tax Brackets and Tax Rates for 2021 - Source www.deskera.com

Editor's Notes: Comprehensive Guide To Income Tax Slabs: Understanding Tax Brackets And Rates have published today. As the tax season approaches, it's crucial to understand income tax slabs and tax brackets to calculate your tax liability accurately. This guide will provide you with a comprehensive understanding of income tax slabs, helping you make informed decisions about your finances.

Our team has done extensive research and analysis to put together this guide, ensuring that it's both informative and easy to understand. Whether you're a salaried employee, a business owner, or an investor, this guide will provide you with the information you need to calculate your taxes and minimize your tax burden.

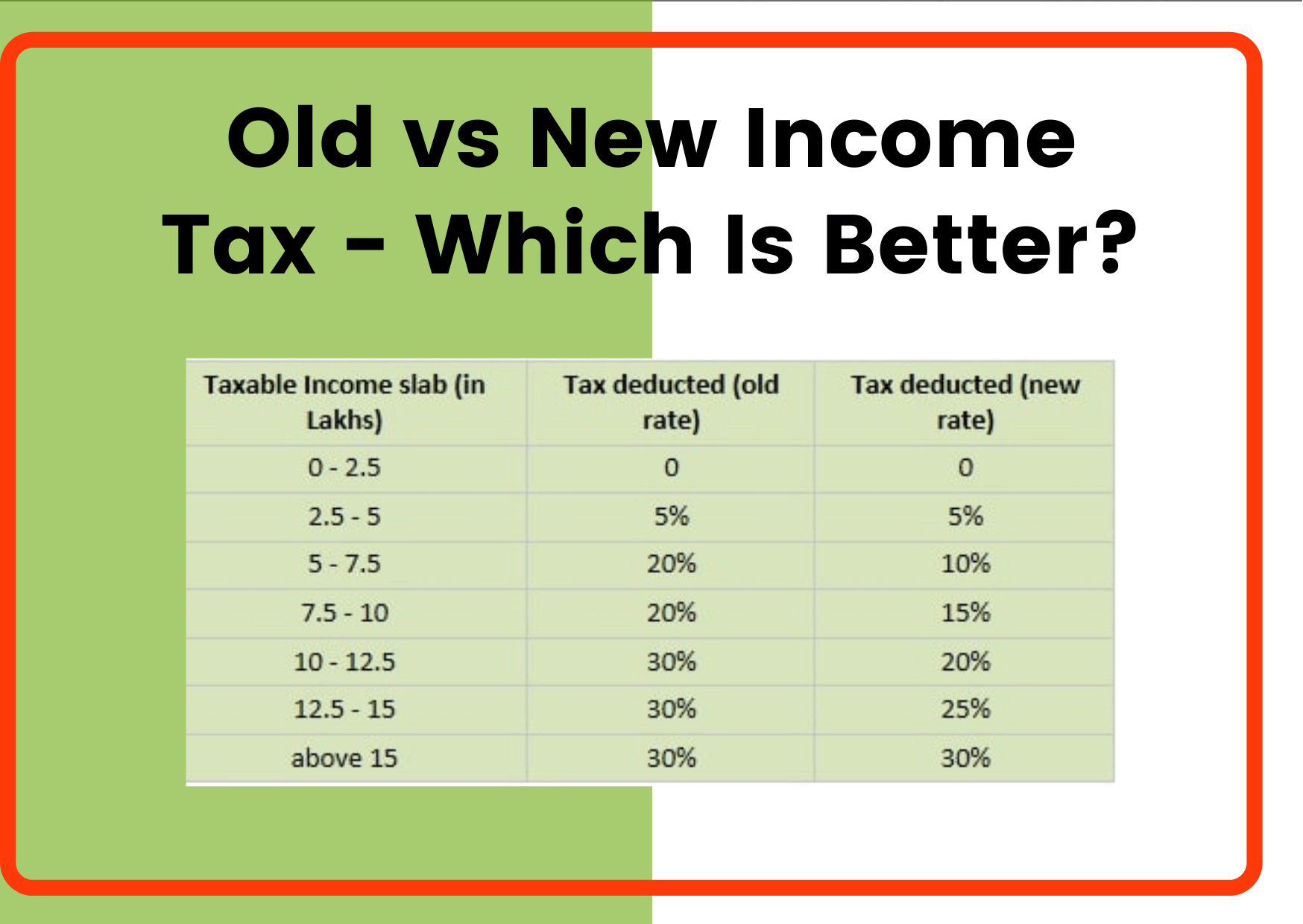

Key Differences:

| Slab | Income Range | Tax Rate |

|---|---|---|

| 1 | Up to 2,50,000 | Nil |

| 2 | 2,50,000 to 5,00,000 | 5% |

| 3 | 5,00,000 to 7,50,000 | 10% |

| 4 | 7,50,000 to 10,00,000 | 15% |

| 5 | 10,00,000 to 12,50,000 | 20% |

| 6 | 12,50,000 to 15,00,000 | 25% |

| 7 | Above 15,00,000 | 30% |

Let's now dive into the main topics of the article:

FAQ

This FAQ section provides answers to common questions and concerns regarding income tax slabs, tax brackets, and rates. It offers a comprehensive understanding of the taxation system to help individuals navigate their tax obligations effectively.

Question 1: What are the different income tax slabs in India for the financial year 2023-24?

Answer: The income tax slabs for the financial year 2023-24 are as follows:

- Income up to INR 2,50,000: Nil

- Income between INR 2,50,001 and INR 5,00,000: 5%

- Income between INR 5,00,001 and INR 10,00,000: 20%

- Income between INR 10,00,001 and INR 12,50,000: 25%

- Income between INR 12,50,001 and INR 15,00,000: 30%

- Income above INR 15,00,000: 35%

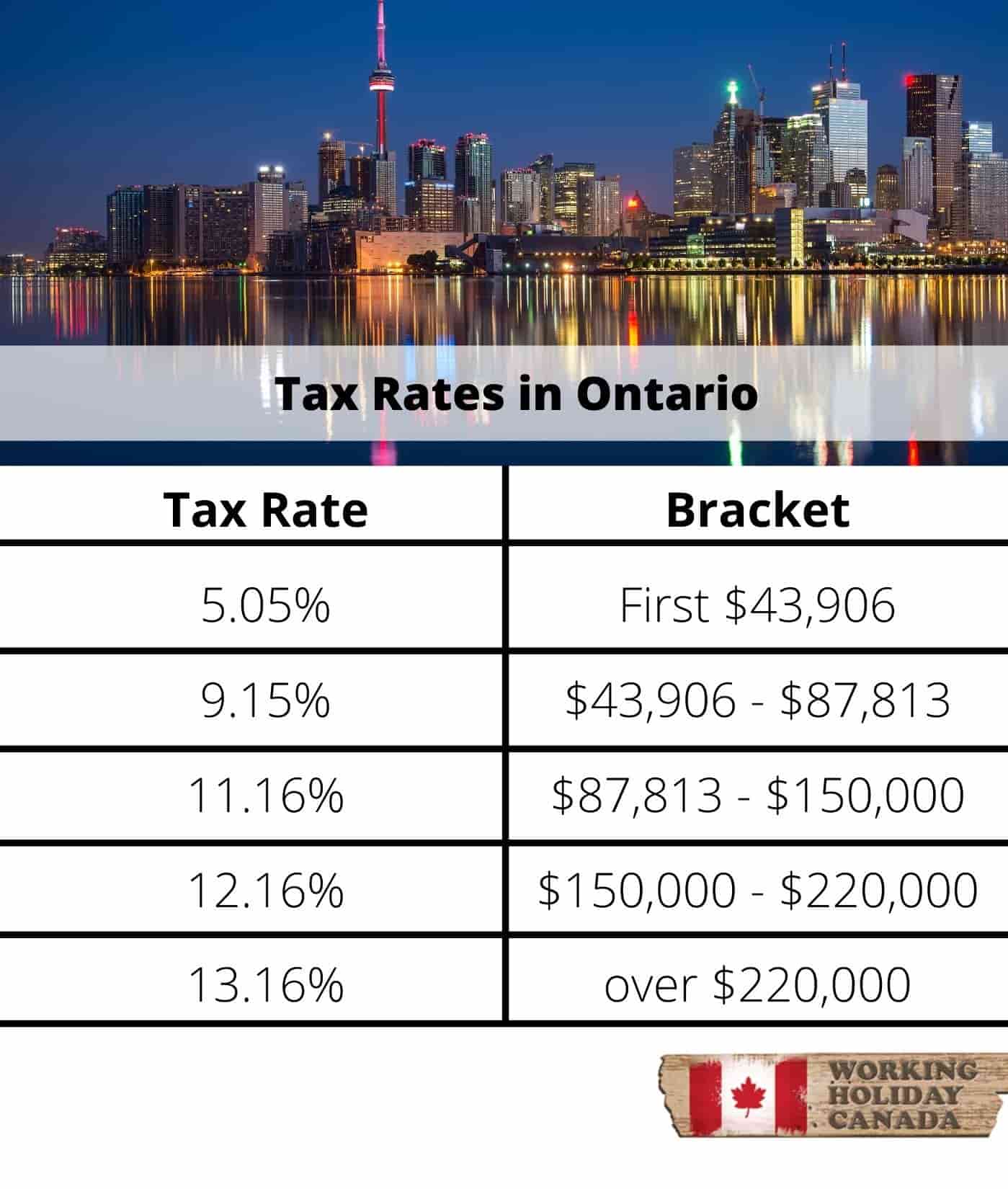

Ontario Income Tax Brackets 2024 Calculator - Brook Collete - Source damarayjaquelyn.pages.dev

Question 2: How does the progressive tax system work in India?

Answer: The progressive tax system in India means that individuals with higher incomes pay a larger percentage of their income in taxes compared to individuals with lower incomes. This system is designed to ensure that the tax burden is distributed more fairly across different income groups, with those who can afford it paying a larger share.

Question 3: What are the available deductions and exemptions under the Income Tax Act?

Answer: The Income Tax Act provides various deductions and exemptions to reduce the taxable income of individuals and entities. These include deductions for standard deductions, life insurance premiums, home loan interest payments, charitable donations, and more. There are also specific exemptions available for certain types of income, such as agricultural income and income from capital gains. It's recommended to consult with a tax professional or refer to the Income Tax Act for a detailed understanding of available deductions and exemptions.

Question 4: How can I calculate my tax liability?

Answer: To calculate your tax liability, you can use the following formula:

- Identify your total income for the financial year.

- Subtract any eligible deductions and exemptions from your total income to arrive at your taxable income.

- Apply the applicable tax rates based on your income slab to calculate the tax payable.

Note that the tax rates may vary depending on factors such as your residential status and age.

Question 5: What are the consequences of not filing income tax returns on time?

Answer: Failure to file income tax returns on time can result in penalties, interest charges, and even prosecution in severe cases. The Income Tax Department may also initiate proceedings to assess your income and levy taxes and penalties based on their estimation, which may be higher than the actual tax liability.

Question 6: How can I avoid common income tax mistakes?

Answer: To avoid common income tax mistakes, it's important to:

- Keep accurate records of your income and expenses.

- Understand the applicable tax laws and regulations.

- Seek professional advice from a qualified tax professional if needed.

- File your tax returns on time and pay your taxes in full.

By following these steps, you can minimize the risk of errors and ensure compliance with tax regulations.

This FAQ section provides a basic overview of some common questions related to income tax slabs, tax brackets, and rates. For more detailed information and personalized guidance, it's advisable to consult with a tax professional or refer to the official Income Tax Act.

Next, let's explore the importance of understanding income tax slabs and tax brackets.

Tips

Understanding Income Tax Slabs is crucial for effective tax planning. To simplify the process, consider the following tips:

Tip 1: Identify your Income Tax Slab

New Income Tax Slabs – CPA Pakistan - Source icpap.com.pk

Determine your income bracket based on your total taxable income. Refer to the latest tax laws for the specific slab rates applicable to your income range.

Tip 2: Calculate your Gross and Net Income

Subtract any deductions and exemptions from your gross income to arrive at your net income, which is subject to taxation.

Tip 3: Utilize Tax-Saving Investments

Explore various investment options that offer tax benefits, such as PPF, ELSS, and NPS, to reduce your taxable income.

Tip 4: Claim Deductions

Identify eligible deductions, such as Section 80C and Section 80D, to further lower your taxable income.

Tip 5: Pay Taxes on Time

Avoid penalties by paying taxes before the due date. Utilize online portals or engage tax professionals for efficient filing and payments.

For a comprehensive understanding of Income Tax Slabs, refer to the Comprehensive Guide To Income Tax Slabs: Understanding Tax Brackets And Rates.

By implementing these tips, individuals can optimize their tax planning and minimize their tax liability.

Comprehensive Guide To Income Tax Slabs: Understanding Tax Brackets And Rates

Navigating the complexities of income tax requires a clear understanding of tax slabs, brackets, and rates. This comprehensive guide delves into these essential aspects, empowering individuals with the knowledge to optimize their tax liabilities.

By grasping these key aspects, individuals gain a comprehensive understanding of income tax slabs. This knowledge equips them to make informed financial decisions, optimize tax savings, and meet their tax obligations accurately. It empowers taxpayers with the ability to navigate the tax system confidently, ensuring compliance while minimizing their tax burden.

New Income Tax Brackets For 2025 Philippines - Sylvia S Cyr - Source sylviascyr.pages.dev

```html

Comprehensive Guide To Income Tax Slabs: Understanding Tax Brackets And Rates

Income tax slabs are an essential component of a comprehensive guide to income tax, as they provide a clear understanding of the tax brackets and rates applicable to different levels of income. This knowledge is crucial for accurate tax calculation and compliance.

Ontario Income Tax Brackets 2024 - Candy Nalani - Source halettewlonee.pages.dev

Understanding tax slabs enables individuals and businesses to estimate their tax liability, plan their financial strategy, and avoid potential penalties. It also helps them make informed decisions about maximizing deductions, exemptions, and other tax-saving measures.

Furthermore, a comprehensive guide to income tax slabs facilitates effective tax administration by providing a structured framework for tax assessment and collection. It ensures transparency and accountability in the taxation process, promoting trust between taxpayers and tax authorities.

```