Pepsico Aktie: Investitionsmöglichkeiten Und Aktuelle Kursentwicklung

Editor's Notes: Pepsico Aktie: Investitionsmöglichkeiten Und Aktuelle Kursentwicklung have published today date

Wir haben einige Analysen durchgeführt, Informationen zusammengetragen und diesen Leitfaden zusammengestellt, um Ihnen bei der Entscheidungsfindung zu helfen.

Aktuelle Angebote — Suzuki Dinnebier Automobile GmbH - Source haendler.suzuki.de

Wichtige Unterschiede oder wichtige Erkenntnisse:

| Merkmal | Pepsico Aktie |

|---|---|

| Branche | Nahrungsmittel- und Getränkeindustrie |

| Tätigkeitsgebiet | Produktion und Vertrieb von Snacks, Getränken und anderen Lebensmitteln |

| Hauptsitz | Purchase, New York, USA |

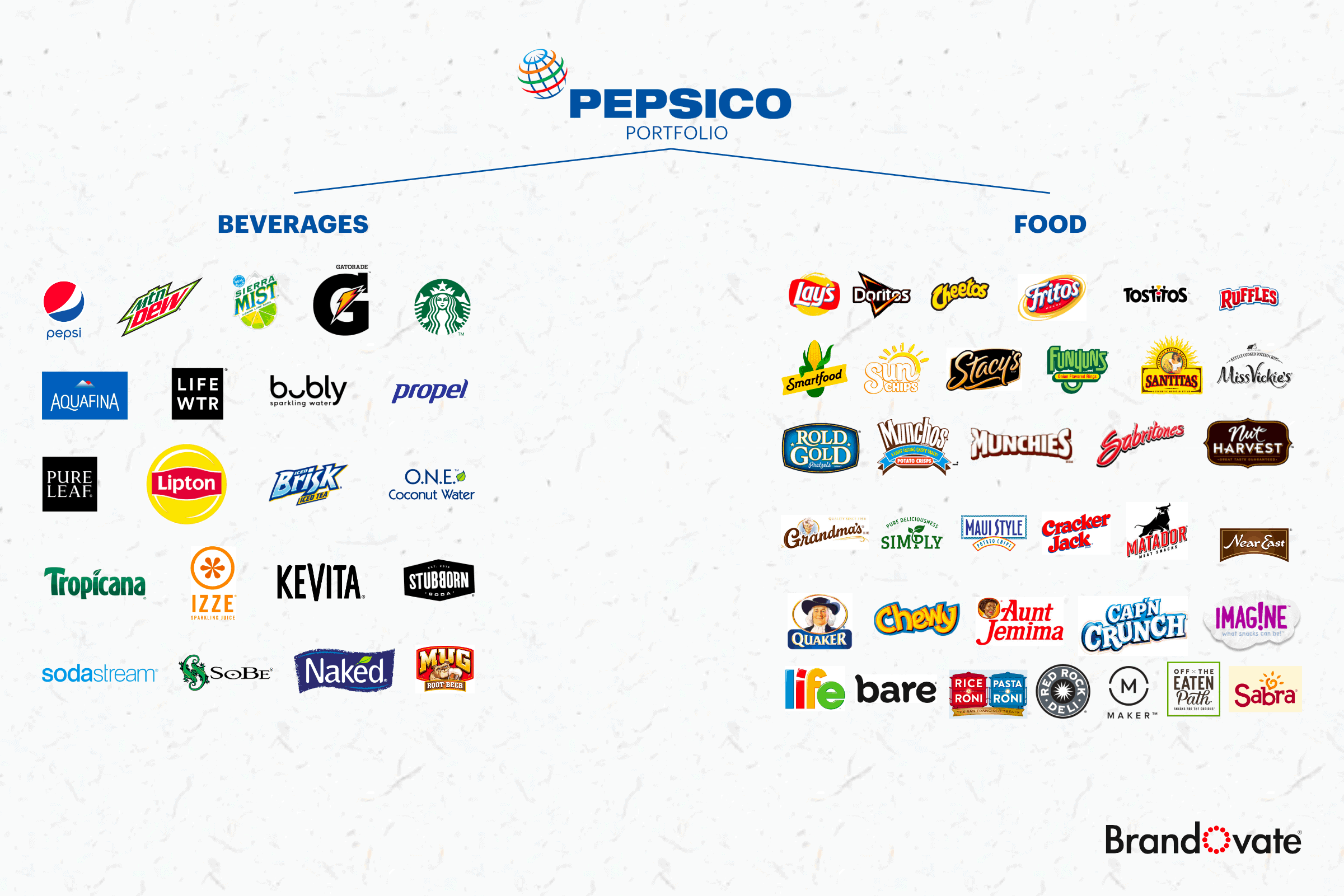

| Wichtige Marken | Pepsi, Lays, Doritos, Mountain Dew, Gatorade |

| Börsennotierung | NASDAQ: PEP |

Übergang zu den Hauptthemen des Artikels:

FAQ

This FAQ section provides answers to common questions and concerns regarding PepsiCo's stock, offering valuable insights into investment opportunities and the current market trajectory.

Question 1: What factors contribute to PepsiCo's consistent performance as an investment option?

PepsiCo's strong brand portfolio, global market presence, and diversified product offerings have historically driven its consistent financial results and shareholder value creation.

Question 2: How is PepsiCo navigating the changing consumer landscape and emerging market trends?

PepsiCo embraces innovation and adapts its product offerings to meet evolving consumer preferences, such as the growing demand for healthier alternatives and personalized experiences.

Question 3: What are the potential risks associated with investing in PepsiCo's stock?

Like any investment, PepsiCo's stock is subject to market fluctuations and industry-specific challenges, including competition, regulatory changes, and supply chain disruptions.

Question 4: How does PepsiCo's dividend policy impact its attractiveness to investors?

PepsiCo has a long-standing commitment to shareholder returns, distributing regular dividends that have grown consistently over time, making it a reliable source of passive income for investors.

Question 5: What are the key metrics to consider when evaluating PepsiCo's stock performance?

Relevant metrics include earnings per share, revenue growth, operating margin, and return on invested capital, providing insights into the company's financial strength and growth prospects.

Question 6: How can investors stay up-to-date on the latest developments and news regarding PepsiCo?

To remain informed, investors can monitor PepsiCo's official website for press releases, financial reports, and investor presentations, as well as reputable financial news sources.

Tips

Consider these tips when considering investing in Pepsico:

Tip 1: Research company fundamentals.

Analyze Pepsico's financial performance, growth potential, and market position to assess its investmentworthiness. Pepsico Aktie: Investitionsmöglichkeiten Und Aktuelle Kursentwicklung provides insights into the company's strengths and weaknesses.

Tip 2: Monitor industry trends.

Stay informed about the food and beverage industry, including consumer preferences, competition, and regulatory changes. This knowledge can help you anticipate potential risks and opportunities.

Tip 3: Diversify your portfolio.

Investing in Pepsico alone carries risk. Spread your investments across different asset classes and companies to mitigate potential losses.

Tip 4: Consider long-term investment.

Pepsico has historically performed well over extended periods.耐心持有股票可以帮助您平滑市场波动并提高长期收益率。

Tip 5: Set realistic expectations.

Don't expect extraordinary returns from Pepsico. While it's a stable company, its growth potential may be limited compared to smaller or emerging companies.

Summary:

Investing in Pepsico requires careful research, industry knowledge, and a long-term perspective. By following these tips, you can make an informed decision about whether Pepsico is a suitable investment for your portfolio.

Pepsico Aktie: Investment Opportunities And Current Price Development

The Pepsico share is one of the most popular investments on the stock market. Investors are attracted by the company's strong brands, global reach, and consistent financial performance. In this article, we will take a closer look at the investment opportunities offered by the Pepsico share and its current price development.

- Strong brands: Pepsico owns some of the world's most iconic brands, including Pepsi, Frito-Lay, Gatorade, and Quaker Oats.

- Global reach: Pepsico's products are sold in over 200 countries and territories, giving the company a truly global reach.

- Consistent financial performance: Pepsico has a long history of delivering consistent financial performance, with steady growth in revenue and earnings.

- Share price appreciation: The Pepsico share price has outperformed the S&P 500 index in recent years, delivering strong returns for investors.

- Dividend payments: Pepsico is a dividend-paying stock, with a current yield of around 2.5%. This provides investors with a steady stream of income.

- Risks: Like all investments, the Pepsico share is not without risks. These include competition, changes in consumer tastes, and economic downturns.

Overall, the Pepsico share is a solid investment opportunity with a long history of delivering strong returns. The company's strong brands, global reach, and consistent financial performance make it a good choice for investors seeking long-term growth and income.

Pepsico Market Share 2024 - Agnes Whitney - Source rowearosalynd.pages.dev

Pepsico Aktie: Investitionsmöglichkeiten Und Aktuelle Kursentwicklung

The Pepsico share is an interesting investment opportunity for several reasons. First, the company is a global leader in the food and beverage industry, with a strong portfolio of brands including Pepsi, Frito-Lay, and Gatorade. Second, Pepsico has a long history of innovation and growth, and is well-positioned to continue to benefit from the growing global demand for food and beverages. Third, the company has a strong financial position, with a solid balance sheet and healthy cash flow.

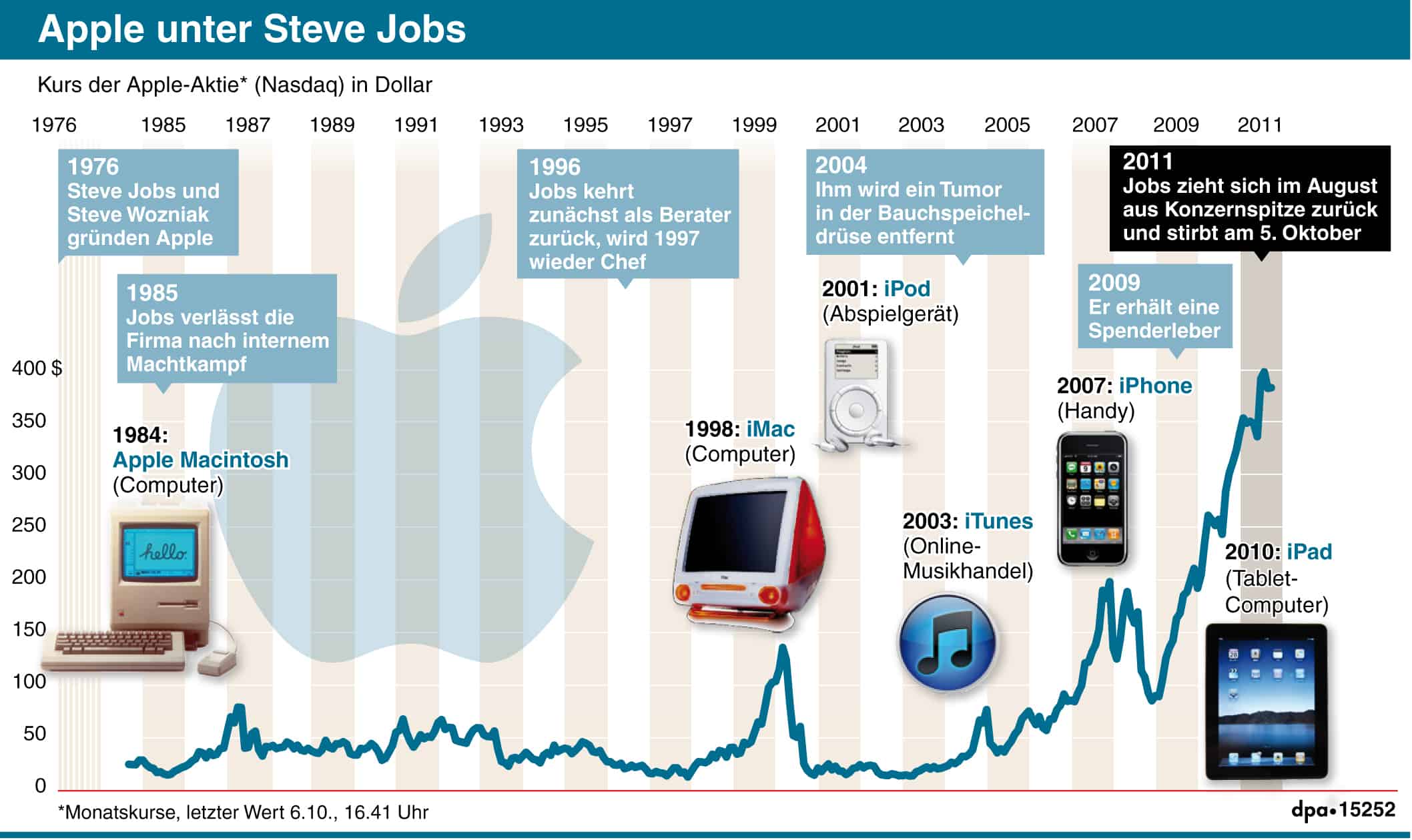

Die Entwicklung der Apple-Aktie unter Steve Jobs › Mac History - Source www.mac-history.de

However, there are also some risks to consider before investing in Pepsico. First, the company is exposed to competition from other food and beverage companies, including Coca-Cola, Nestlé, and Unilever. Second, the company is dependent on the global economy, and could be impacted by economic downturns. Third, the company's products are high in sugar and sodium, which could lead to negative publicity or regulation.

Overall, the Pepsico share is an interesting investment opportunity with both potential rewards and risks. Investors should carefully consider the risks and rewards before making a decision about whether or not to invest in the company.

Conclusion

The Pepsico share is a complex investment opportunity with both potential rewards and risks. Investors should carefully consider the risks and rewards before making a decision about whether or not to invest in the company.

One of the key risks to consider is the company's exposure to competition from other food and beverage companies. Coca-Cola, Nestlé, and Unilever are all major competitors, and they have the resources to challenge Pepsico's market share.

Another risk to consider is the company's dependence on the global economy. If the global economy goes into a downturn, it could have a negative impact on Pepsico's sales and profits.

Finally, investors should also consider the company's products. Pepsico's products are high in sugar and sodium, which could lead to negative publicity or regulation. This could have a negative impact on the company's sales and profits.

Overall, the Pepsico share is an interesting investment opportunity with both potential rewards and risks. Investors should carefully consider the risks and rewards before making a decision about whether or not to invest in the company.