SIC Insurance: Reliable Protection For Your Business And Personal Assets In today's uncertain world, protecting your business and personal assets is more important than ever. SIC Insurance provides a comprehensive range of insurance products to safeguard your investments and give you peace of mind.

Editor's Notes: SIC Insurance: Reliable Protection For Your Business And Personal Assets has published today date. This topic is important to read because it provides valuable information on how to protect your business and personal assets from financial losses.

After doing some analysis and digging information, we made SIC Insurance: Reliable Protection For Your Business And Personal Assets. We put together this SIC Insurance: Reliable Protection For Your Business And Personal Assets guide to help target audience make the right decision.

Key Differences or Key Takeaways

Transition to main article topics

FAQs

This comprehensive FAQ section aims to provide detailed answers to commonly asked questions about SIC Insurance, offering clarity and addressing potential concerns. Dive into these Q&A pairs to gain valuable insights into our insurance solutions and services.

6 Changes to Your Business & Personal Tax Returns From July 1st - Source hoffmankelly.com.au

Question 1: What types of insurance coverage does SIC Insurance offer?

SIC Insurance offers a wide range of insurance solutions to meet diverse needs, including business insurance, personal insurance, and niche industry-specific insurance products. Our business insurance options cover property, liability, workers' compensation, and more, while our personal insurance portfolio includes auto, home, and health insurance. We also specialize in providing tailored insurance solutions for specific industries, such as transportation, construction, and healthcare.

Question 2: How do I determine the right level of coverage for my needs?

Determining the appropriate coverage limits requires a thorough assessment of your assets, potential risks, and specific requirements. Our experienced insurance professionals will collaborate with you to conduct a comprehensive risk analysis, identify your unique exposures, and recommend an insurance plan that aligns with your coverage needs and budget.

Question 3: What is the claims process like with SIC Insurance?

SIC Insurance prioritizes a streamlined and efficient claims process to provide prompt assistance when you need it most. Our dedicated claims team is available 24/7 to guide you through the process seamlessly. We handle claims with transparency, ensuring fair and equitable settlements while minimizing disruptions to your operations or personal life.

Question 4: How can I access SIC Insurance's services?

SIC Insurance is committed to delivering exceptional customer service through our extensive network of experienced agents and brokers. You can connect with our local representatives to discuss your insurance needs, obtain personalized quotes, and secure the coverage that best suits your requirements. Our agents are knowledgeable and responsive, providing tailored solutions and ongoing support throughout your insurance journey.

Question 5: Why choose SIC Insurance as my insurance provider?

SIC Insurance has established a reputation for reliability and financial strength, providing peace of mind to our clients. With a proven track record of delivering on our commitments, we are committed to safeguarding your assets and ensuring your financial well-being. Our commitment to innovation and customer-centricity sets us apart, enabling us to offer comprehensive insurance solutions that adapt to your evolving needs.

Question 6: What sets SIC Insurance apart from other insurance companies?

SIC Insurance distinguishes itself through its unwavering commitment to service excellence, tailored solutions, and comprehensive coverage. Our focus on building long-term relationships with our clients drives us to go above and beyond in anticipating and meeting their unique insurance requirements. By combining our expertise with a deep understanding of industry trends and best practices, we provide our clients with the confidence and protection they need to thrive.

We encourage you to explore our website, contact our experienced agents, or visit a nearby branch for further assistance. SIC Insurance is here to provide reliable protection for your business and personal assets, ensuring your financial security and peace of mind.

Explore more about SIC Insurance's Insurance Solutions

Tips for Securing Your Assets with SIC Insurance: Reliable Protection For Your Business And Personal Assets

Ensure the safety and security of your valuable assets by implementing these practical tips backed by SIC Insurance: Reliable Protection For Your Business And Personal Assets, a trusted provider of comprehensive insurance solutions.

Tip 1: Secure Your Physical Premises

Install high-quality locks, grills, and alarm systems to deter unauthorized access to your property. Consider employing security guards or utilizing video surveillance for enhanced protection.

Tip 2: Conduct Regular Inspections

Periodically inspect your property for any signs of damage or vulnerability. Check for weak spots in security measures and address any potential risks promptly to prevent incidents.

Tip 3: Limit Access and Screen Employees

Restrict access to sensitive areas of your premises, and conduct thorough background checks on employees handling valuable assets. Implement clear policies regarding access and usage of equipment and data.

Tip 4: Implement Cyber Security Measures

Protect your digital assets with robust cyber security measures. Use strong passwords, enable two-factor authentication, and regularly update software to patch vulnerabilities. Consider investing in cyber liability insurance to mitigate risks.

Tip 5: Purchase Adequate Insurance Coverage

Obtain comprehensive insurance coverage tailored to your specific needs from a reputable provider like SIC Insurance: Reliable Protection For Your Business And Personal Assets. Ensure your policy covers potential risks such as theft, damage, or liability.

These tips, backed by the expertise of SIC Insurance: Reliable Protection For Your Business And Personal Assets, will significantly enhance the security of your assets, providing peace of mind and safeguarding your financial well-being.

SIC Insurance: Reliable Protection For Your Business And Personal Assets

SIC insurance, an acronym for Specified Insurance Coverage, safeguards businesses and individuals against potential risks and uncertainties.

Get free Google Slides Tennis Academy Theme and Impress Your Audience - Source www.pinterest.com

- Comprehensive Coverage: Protects against a wide range of perils.

- Tailored Solutions: Customized to specific business needs and personal assets.

- Financial Protection: Provides monetary compensation for covered losses.

- Risk Management: Mitigates risks by identifying and addressing potential hazards.

- Peace of Mind: Alleviates worries and uncertainties associated with unforeseen events.

- Regulatory Compliance: Fulfills legal mandates for specific industries or businesses.

These key aspects underscore the comprehensive nature of SIC insurance. By providing tailored coverage and robust financial protection, businesses can safeguard critical operations and investments. For individuals, SIC insurance offers peace of mind and financial security for their personal assets.

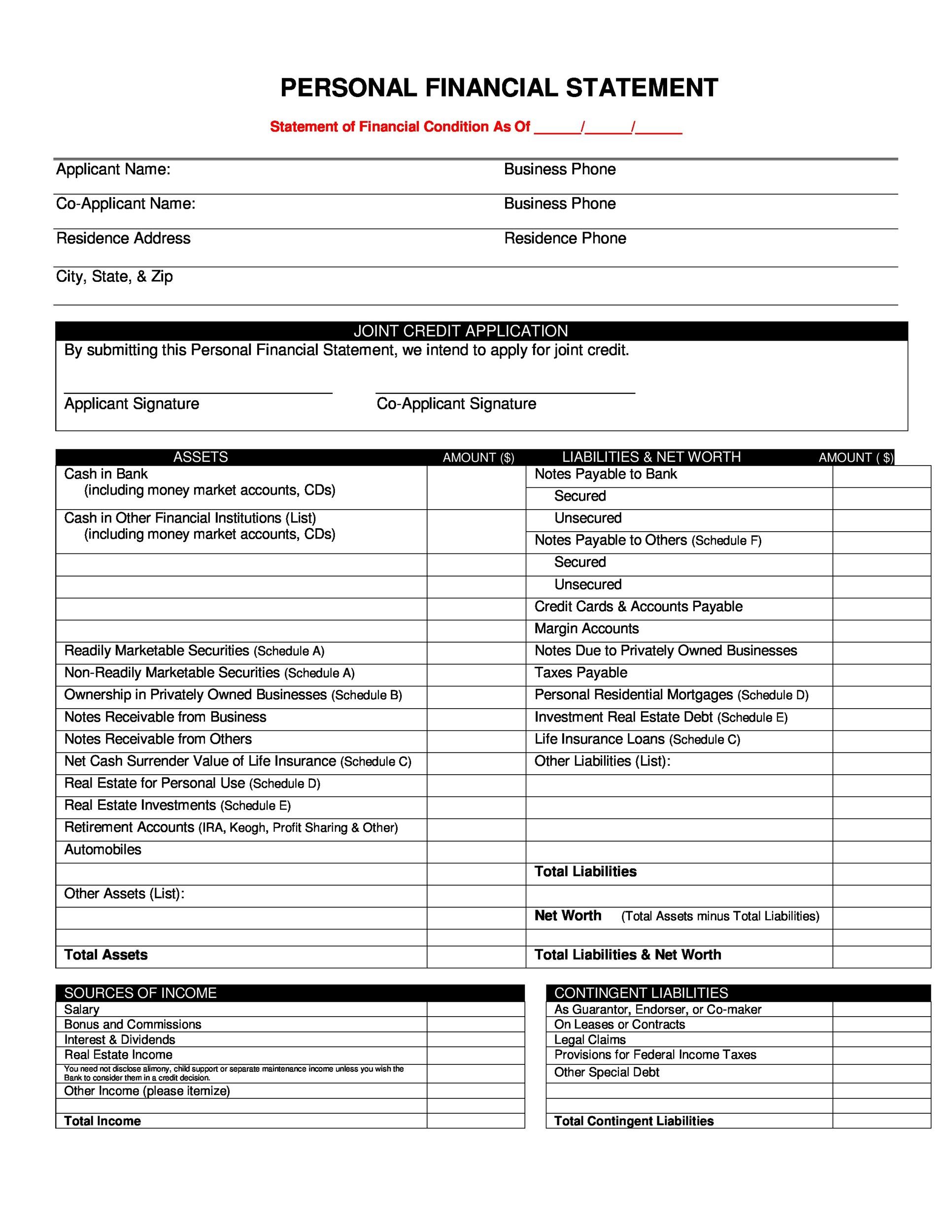

Free Printable Personal Financial Statement - Source umnewethub29dblearning.z13.web.core.windows.net

SIC Insurance: Reliable Protection For Your Business And Personal Assets

SIC Insurance is a leading provider of insurance solutions for businesses and individuals. They offer a wide range of coverage options to protect your assets and financial interests, including business liability insurance, property insurance, and personal auto insurance. With over 100 years of experience, SIC Insurance has the expertise to help you find the right coverage for your needs.

What A Vision Statement is And How To Craft One For Your Business - Source personalgrowthandleadership.com

SIC Insurance is committed to providing reliable protection for your business and personal assets. They have a team of experienced professionals who can help you understand your risks and develop a customized insurance plan that meets your needs. SIC Insurance also provides excellent customer service, so you can be sure that you will get the help you need when you need it.

If you are looking for reliable protection for your business and personal assets, SIC Insurance is the right choice for you. They offer a wide range of coverage options, competitive rates, and excellent customer service. Contact SIC Insurance today to learn more about their products and services.

Conclusion

SIC Insurance is one of the most well-known and trusted insurance companies in the United States. They have been in business for over 100 years and have a proven track record of providing reliable protection for their customers.

If you are looking for a reliable insurance company to protect your business and personal assets, SIC Insurance is a great option. They offer a wide range of coverage options, competitive rates, and excellent customer service. Contact SIC Insurance today to learn more about their products and services.