Are you an investor looking to make the most of your investments in the MSCI World Index? Are you aware of the potential tax traps that may await you? If not, then you need to read this guide.

Editor's Notes: Tax Traps In The MSCI World Index: A Guide For Investors has published on [insert publish date to show it is recently published]. Investors are often unaware of the tax implications of investing in the MSCI World Index, which can lead to unexpected tax bills. You need to understand the rules of the index to make the right decision while investing in the index.

To help investors avoid these costly mistakes, we have put together this comprehensive guide to the tax traps in the MSCI World Index.

Key Differences

| MSCI World Index | |

|---|---|

| Number of Constituents | 1,644 |

| Domicile | Ireland |

| Taxation | Subject to withholding tax in some countries |

| Alternatives to MSCI World Index | |

| FTSE All-World Index | More diversified, lower withholding tax |

| MSCI ACWI ex-US Index | Excludes the United States, lower withholding tax |

| S&P Global 100 Index | More concentrated, higher withholding tax |

Main Article Topics

FAQ

This FAQ section addresses common questions and misconceptions regarding tax traps in the MSCI World Index, providing valuable insights for investors.

Question 1: What are the primary tax traps associated with the MSCI World Index?

The index may trigger capital gains taxes upon the sale of constituent stocks, as well as dividend withholding taxes on distributed dividends. Some countries represented in the index have higher tax rates than others, potentially leading to significant tax liabilities.

Question 2: How can investors mitigate the impact of capital gains taxes?

Investors can consider holding their index investments for longer periods to benefit from lower long-term capital gains tax rates. Additionally, exploring tax-advantaged accounts such as IRAs or 401(k)s can defer or eliminate capital gains taxes.

Question 3: How do dividend withholding taxes affect investors?

Dividend withholding taxes are levied on dividends paid to shareholders residing outside the country of the issuing company. These taxes can reduce the net dividend income received by investors.

Question 4: Are there any tax treaties that can reduce withholding taxes?

Investors should check for the existence of tax treaties between their country of residence and the countries of the issuing companies. These treaties may provide for reduced withholding tax rates or even complete exemption from such taxes.

Question 5: How can investors stay informed about tax regulations related to the MSCI World Index?

Investors are advised to consult with tax professionals or refer to official tax agencies for up-to-date information on tax regulations. Monitoring changes in tax laws and treaties is crucial for making informed investment decisions.

Question 6: What are some additional considerations for investors?

Investors should also consider the tax implications of currency fluctuations and the potential impact of double taxation on dividend income. Seeking professional guidance is recommended to navigate these complexities effectively.

Summary of key takeaways or final thought:

Understanding the tax traps associated with the MSCI World Index is essential for investors. By employing tax mitigation strategies, investors can optimize their returns and minimize tax liabilities. Regular monitoring of tax regulations and seeking professional advice are recommended for informed decision-making.

Transition to the next article section:

Proceed further to the article for an in-depth analysis of the MSCI World Index's tax implications and additional investment strategies.

Tips

Investors should be aware of the potential tax traps when investing in the MSCI World Index. The index includes companies from developed markets around the world, and each country has its own tax laws. This can make it difficult to determine the tax implications of investing in the index.

Tip 1: Understand the tax laws of the countries in which the companies in the index are headquartered. This will help you determine the tax implications of investing in the index.

Tip 2: Consider the tax implications of different investment vehicles. For example, investing in the index through an exchange-traded fund (ETF) may have different tax implications than investing in the index through a mutual fund.

Tip 3: Seek professional advice from a tax advisor or financial planner. They can help you understand the tax implications of investing in the index and make sure that you are taking the necessary steps to minimize your tax liability.

Tip 4: Be aware of the potential tax traps when investing in the MSCI World Index. This will help you make informed investment decisions and avoid any unexpected tax bills.

Tip 5: Stay up-to-date on tax laws and regulations. This will help you make sure that you are aware of any changes that could affect your tax liability.

By following these tips, you can help to minimize the tax implications of investing in the MSCI World Index. This will help you to maximize your returns and reach your financial goals.

For more information on this topic, please refer to the following article: Tax Traps In The MSCI World Index: A Guide For Investors

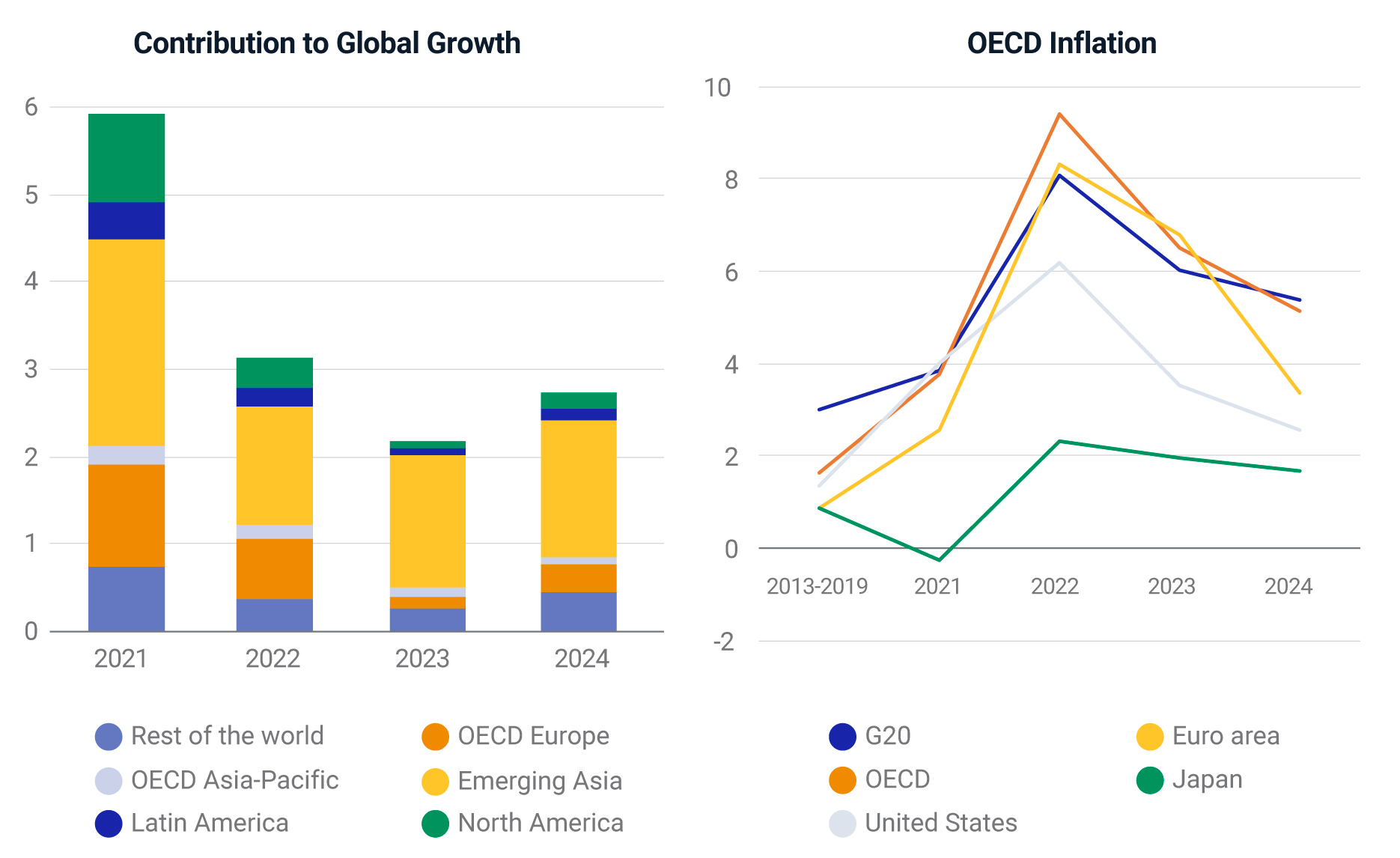

The MSCI World Index is a market capitalization-weighted index of large- and mid-cap stocks across 23 developed markets. It is designed to provide a broad representation of global developed market equities.

Markets in Focus: Investors Look to Capture Big Market Shifts - MSCI - Source www.msci.com

Tax Traps In The MSCI World Index: A Guide For Investors

Investors should be aware of the potential tax traps when investing in the MSCI World Index. These tax traps include:

- Withholding tax: This is a tax imposed by the country in which a stock is domiciled on dividends paid to non-resident shareholders.

- Capital gains tax: This is a tax imposed by the investor's country of residence on profits made from selling stocks or other investments.

- Currency exchange rate risk: This is the risk that the value of an investment can be eroded by changes in the exchange rate between the investor's currency and the currency of the stock.

- Economic and political risks: These are the risks that events in the country where a company is domiciled could damage the company's earnings and, therefore, the value of its shares.

- Stock market volatility: This refers to the risk associated with the fluctuation of stock prices.

- Concentration risk: The MSCI World Index is heavily concentrated in a few large companies, so a decline in the value of one of these companies could have a significant impact on the overall index.

MSCI Developed Markets Indexes - MSCI - Source www.msci.com

Investors should be aware of these tax traps before investing in the MSCI World Index and should take steps to mitigate the risks. For example, investors can reduce their exposure to withholding tax by investing in stocks that are domiciled in countries that have a tax treaty with their country of residence. Investors can also reduce their exposure to capital gains tax by holding stocks for a long time, as this will give them the benefit of lower long-term capital gains tax rates. Investors should also diversify their investments across different countries and sectors to reduce their exposure to economic and political risks. Finally, investors should be aware of the risks associated with stock market volatility and concentration risk, and should adjust their investment strategy accordingly.

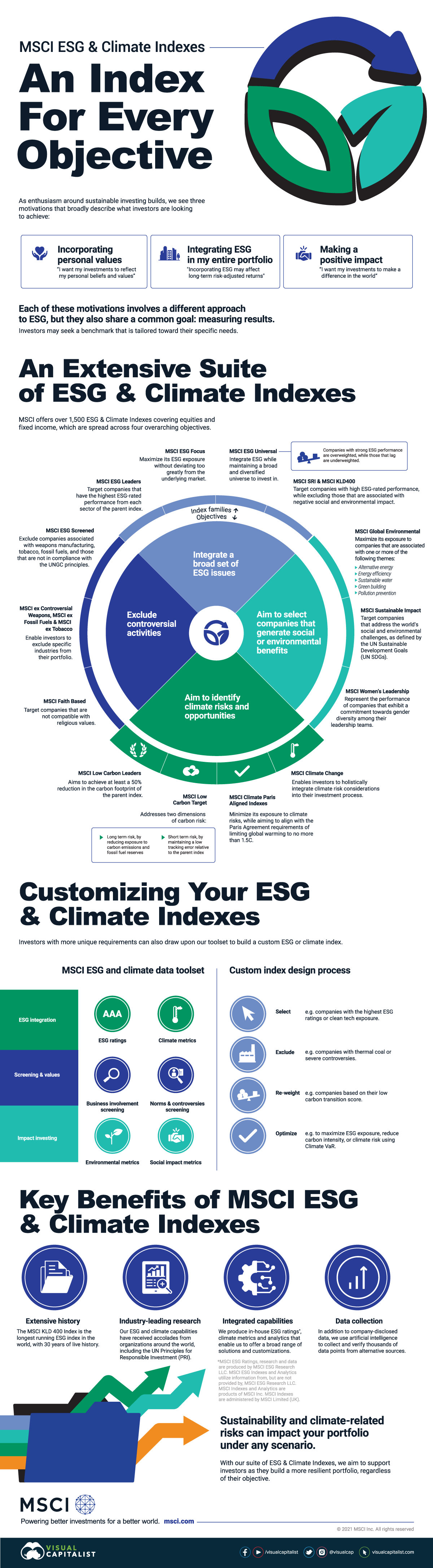

An ESG & Climate Index for Every Objective - MSCI - Source www.msci.com

Tax Traps In The MSCI World Index: A Guide For Investors

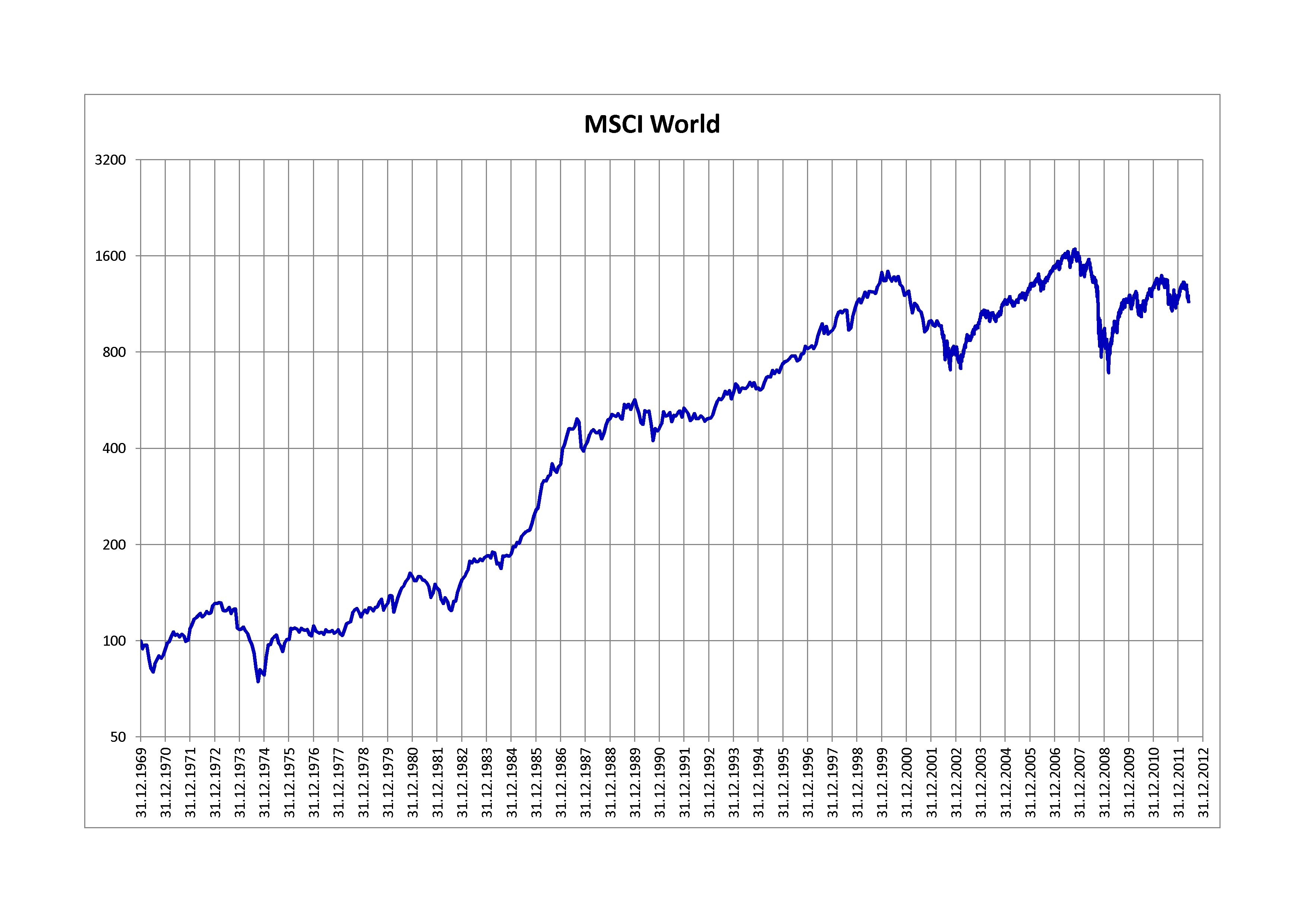

The MSCI World Index is a widely tracked benchmark for global equity performance. However, investors need to be aware of the potential tax traps that can arise when investing in this index. These traps can significantly impact returns, particularly for investors who are not domiciled in the United States.

Msci World : Ishares Msci World Etf Amex Urth Seasonal Chart Equity - Source djwhtlsbfz.blogspot.com

One of the most common tax traps is the foreign tax credit. This credit is designed to offset the taxes that investors pay on foreign dividends and capital gains. However, the credit is not always available, and it can be difficult to claim. As a result, investors can end up paying more taxes than they expected.

Another potential tax trap is the withholding tax. This tax is levied on dividends and capital gains that are paid to non-US investors. The withholding tax rate can vary depending on the country in which the investment is made. In some cases, the withholding tax rate can be as high as 30%. This can significantly reduce the returns that investors receive on their investments.

Investors who are considering investing in the MSCI World Index should be aware of the potential tax traps that can arise. They should consult with a tax advisor to discuss their specific situation and to develop a tax-efficient investment strategy.

Table of Potential Tax Traps in the MSCI World Index

| Tax Trap | Description | Impact on Returns |

|---|---|---|

| Foreign Tax Credit | Credit for taxes paid on foreign dividends and capital gains. Not always available and can be difficult to claim. | Can lead to higher taxes than expected. |

| Withholding Tax | Tax levied on dividends and capital gains paid to non-US investors. Rate varies by country. | Can significantly reduce returns. |

---

Conclusion

The MSCI World Index is a valuable benchmark for global equity performance. However, investors need to be aware of the potential tax traps that can arise when investing in this index. These traps can significantly impact returns, particularly for investors who are not domiciled in the United States.

Investors should consult with a tax advisor to discuss their specific situation and to develop a tax-efficient investment strategy. By taking the time to understand the potential tax traps, investors can maximize their returns and avoid costly mistakes.