Immerse yourselves in the future of banking with "Ing-Diba: The Modern Banking Experience For Digital Natives."

Editor's Notes: This article dives deep into the banking system made for digital banking users, Ing-Diba: The Modern Banking Experience For Digital Natives, that was made available to the public on [Date] and has remained popular ever since.

We present you this Ing-Diba: The Modern Banking Experience For Digital Natives guide, which we have compiled with great effort after examining various sources and conducting thorough research, to help you make an informed choice.

FAQs

Discover comprehensive answers to frequently asked questions about Ing-Diba, the digital banking solution designed for tech-savvy individuals.

Digitalbanking - Gambaran - Source freemium38.tdoc.es

Question 1: What distinguishes Ing-Diba from traditional banking institutions?

Ing-Diba prioritizes convenience, flexibility, and transparency. Customers enjoy 24/7 account access, fee transparency, and competitive interest rates without physical branches or tellers.

Question 2: How secure is Ing-Diba's platform?

Ing-Diba implements robust security measures, including two-factor authentication, encryption, and compliance with the latest industry standards. Your financial data remains protected, ensuring peace of mind.

Question 3: What types of accounts does Ing-Diba offer?

Ing-Diba offers a range of account options, including checking, savings, and investment accounts. Whether managing daily expenses, saving for the future, or investing wisely, Ing-Diba caters to diverse financial needs.

Question 4: How can I access my Ing-Diba account?

Ing-Diba provides seamless access to your account through its user-friendly mobile app and online banking portal. Manage your finances conveniently from anywhere, anytime.

Question 5: What are the benefits of using Ing-Diba's mobile app?

The Ing-Diba mobile app empowers customers with instant account overview, fast money transfers, bill payments, and the ability to contact customer support with ease. Enjoy banking on the go, at your fingertips.

Question 6: How does Ing-Diba support its customers?

Ing-Diba values customer satisfaction and provides comprehensive support through dedicated phone lines, email assistance, and a comprehensive FAQ section. Their knowledgeable team is always available to address inquiries and resolve any banking needs.

Ing-Diba's digital banking experience empowers individuals with convenient, secure, and transparent financial management. Embrace the future of banking with Ing-Diba.

Next Article Section:

Tips

Explore Ing-Diba: The Modern Banking Experience For Digital Natives for innovative banking solutions and cutting-edge tools for managing finances. Below are top tips to enhance your digital banking journey.

Tip 1: Utilize Mobile Banking: Access banking services conveniently and securely from your smartphone or tablet anytime, anywhere. Perform transactions, manage accounts, and stay informed about financial activities.

Tip 2: Set Financial Goals: Define clear financial objectives and track progress towards them with the budgeting and goal-tracking features. Stay motivated and organized while achieving financial aspirations.

Tip 3: Maximize Savings: Take advantage of high-yield savings accounts, automate savings transfers, and earn competitive interest on deposits. Grow wealth and achieve long-term financial goals.

Tip 4: Leverage Technology: Embrace advanced tools such as virtual assistants, chatbots, and AI-powered insights. Simplify banking tasks, automate processes, and make informed financial decisions.

Tip 5: Enhance Security: Prioritize cybersecurity by using strong passwords, enabling multi-factor authentication, and monitoring account activity vigilantly. Protect financial data and prevent unauthorized access.

By following these tips, individuals can optimize their digital banking experience, achieve financial well-being, and stay ahead in the digital banking landscape.

Ing-Diba: The Modern Banking Experience for Digital Natives

In a digital age, banking has evolved, and Ing-Diba stands out as a pioneer in providing a modern banking experience tailored specifically for digital natives. This article explores six key aspects that define Ing-Diba's innovative approach to banking, paving the way for a seamless and technologically advanced banking journey.

Customer experience in times of Digital natives - Source www.moflixgroup.com

- Digital-first banking: Ing-Diba operates exclusively online, offering a fully digital banking experience accessible through its website and mobile app.

- Cutting-edge technology: Ing-Diba embraces the latest advancements in financial technology, incorporating innovative features such as biometric authentication and AI-powered financial insights.

- Seamless user experience: Ing-Diba's platform is designed with a focus on intuitive navigation, providing a user-friendly experience that simplifies banking transactions.

- Personalized services: Ing-Diba leverages data analytics to tailor its services to each customer's unique needs, offering personalized recommendations and tailored financial advice.

- Innovative products: Ing-Diba continuously introduces new and innovative banking products, such as mobile payments, digital wallets, and tailored investment options, catering to the evolving needs of digital natives.

- Exceptional customer support: Ing-Diba places high value on customer satisfaction, providing 24/7 support through multiple channels, including live chat, email, and social media.

These aspects combine to create a banking experience that is not only convenient and efficient but also secure and reliable. Ing-Diba's commitment to digital innovation and customer-centricity has positioned it as a leading force in modern banking, empowering digital natives with the tools and services they need to manage their finances confidently in the digital age.

ING Online Banking - Roland Illés - Source rolandilles.com

Ing-Diba: The Modern Banking Experience For Digital Natives

In today's digital age, banking is evolving to meet the needs of a tech-savvy generation. Ing-Diba, a leading online bank, is at the forefront of this transformation, offering a modern banking experience tailored to the demands of digital natives.

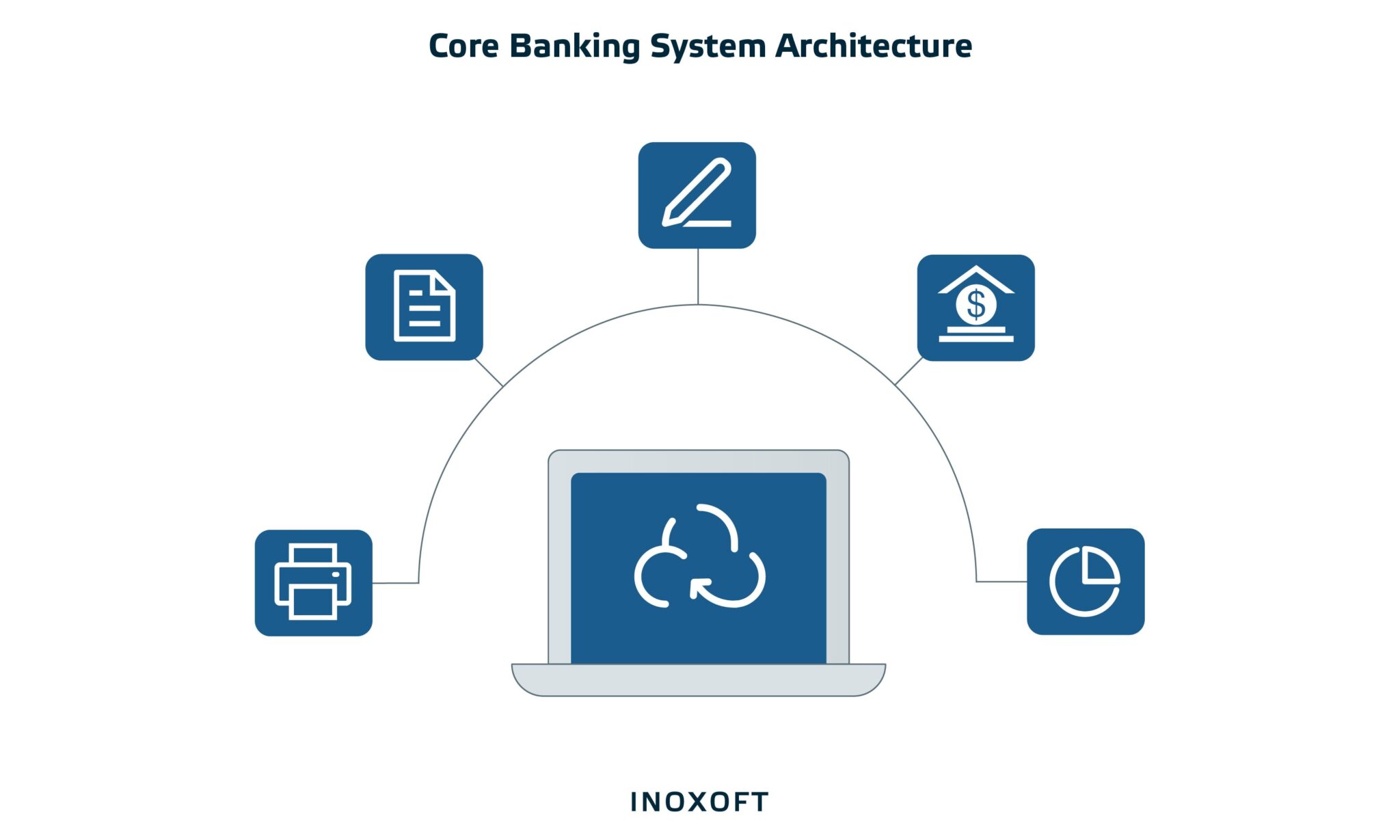

A Complete Guide to Building a Digital Banking Architecture - Inoxoft - Source inoxoft.com

At its core, Ing-Diba's appeal lies in its seamless digital platform. Customers can manage their finances from anywhere, anytime, using their smartphones or computers. The bank's intuitive user interface makes it effortless to conduct transactions, track spending, and access account information.

Beyond convenience, Ing-Diba prioritizes security. Its advanced encryption protocols and biometric authentication ensure the safety of customer data. The bank also offers innovative features such as real-time fraud alerts and personalized security recommendations.

Ing-Diba understands the financial needs of digital natives. They offer tailored products and services that cater to their unique lifestyles. For instance, the bank provides student accounts with zero fees and competitive interest rates. They also offer flexible savings accounts and investment options designed to help customers grow their wealth.

In conclusion, Ing-Diba's modern banking experience is a testament to the power of digital innovation in the financial industry. By embracing technology and tailoring its services to the needs of digital natives, Ing-Diba empowers customers to manage their finances seamlessly, securely, and in a way that aligns with their digital-first lifestyle.

Conclusion

Ing-Diba's modern banking experience is not just a trend but a necessity in today's digital world. By seamlessly blending innovation and customer-centricity, Ing-Diba has set a benchmark for the future of banking.

As technology continues to advance, Ing-Diba's commitment to digital transformation will undoubtedly lead the way. The bank's unwavering focus on providing a secure, convenient, and tailored banking experience will empower digital natives to thrive financially in the years to come.